New 5G Study Shows Full Market Penetration Is Still Far Off

The 5G revolution may be on the way, but it isn’t here yet. That much is clear from the state of 5G rollout in the U.S., but it’s just as true internationally.

The British technology research firm Omdia presented the results of its newest study on 5G on Thursday morning at a webinar commissioned by the European network operator Orange. Its finding is that while 5G is growing rapidly quarter-to-quarter, it has yet to reach the overall “sweet spot” that would indicate widespread adoption.

Image used with permission by copyright holder

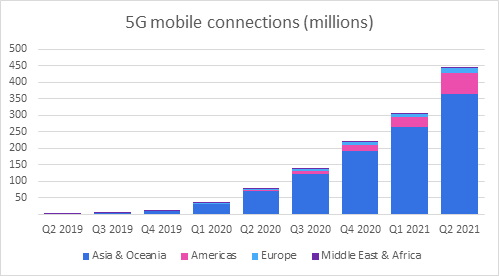

Image used with permission by copyright holder

In the study, the sweet spot is generally defined as the point where 5G starts being revenue positive. As per Omdia’s findings, only 14% of currently extant 5G networks have reached that sweet spot, which is considered to be a total of 10% subscriber penetration. Nearly 150 operators worldwide had launched some amount of 5G coverage by June 30, but only 21 of them had managed to get to a point where at least 10% of their subscribers had regular 5G access.

How the sweet spot itself was chosen is based on how the 5G market is behaving in South Korea, which is the current leader in 5G penetration. China’s 5G subscriptions are also rising steadily, with a 4.7% bump in the first quarter of 2021 and a 3.7% bump in the second quarter, for a total of 318 million overall. If the numbers continue along this curve, Omdia predicts another 24 markets will reach 10% 5G penetration by the end of 2021.

In the study, that sweet spot is generally defined as the point where 5G starts being revenue positive.

Currently, 5G penetration is highest in China, South Korea, Japan, and the United States, with a full 82% of available subscriptions found in Asia. Of that 82%, 87% of them are in China. The small but growing 5G penetration outside of those markets includes Finland and Ireland, both of which have surpassed 5% overall.

“5G is still in its infancy, and we have yet to see its full potential from a technology and commercial perspective,” said Ronan De Renesse, senior research director for Omdia. “Similar to 4G when it launched, 5G adoption is mostly supply led, which means that demand for 5G needs to be created by the industry. Operators in China and South Korea have shown that if you put 5G in the hands of consumers, then revenues are likely to follow.”

Omdia’s prediction is that 37 additional markets will hit 10% 5G penetration in 2022, with over 100 following suit by 2026.

Omdia’s prediction is that 37 additional markets will hit 10% 5G penetration in 2022, with over 100 following suit by 2026. However, there are markets where the expense of 5G will slow its rollout, as a first-time mobile customer in many African nations could see a 100% increase in their monthly mobile bill by adopting 5G. Like any new tech, 5G is likely to be an expensive toy for nerds for a couple of years until compatible devices get cheap enough for mainstream customers.