5G Nationwide vs. 5G Ultra Wideband: What’s the difference?

The rollout of 5G networks across the U.S. has been a bit more complicated than prior cellular technologies. While this is primarily due to a broader range of frequencies used by 5G networks, cellular carriers have added to the confusion by treating us to a complicated array of terms like 5G Plus, 5G Nationwide, 5G Ultra Wideband, 5G Ultra Capacity, and 5G Extended Range.

With so many different terms, it can be hard to figure out what it all means — especially when the carriers have unique names for similar types of 5G services. Nowhere has this been more apparent recently than with Verizon, which has rolled out its 5G services somewhat differently from the rest. The carrier has now settled on two broad terms to describe its 5G coverage: 5G Nationwide and 5G Ultra Wideband. But what exactly do these mean, and how did we get here?

SOPA Images / Getty Image

SOPA Images / Getty Image

Verizon’s original 5G network

When Verizon began rolling out its 5G service, it took the unique approach of focusing exclusively on the extremely high frequency (EHF) millimeter wave (mmWave) band. The frequencies in this band live well above anything typically used by cellular and Wi-Fi networks; that’s up in the 28GHz range for Verizon’s 5G network.

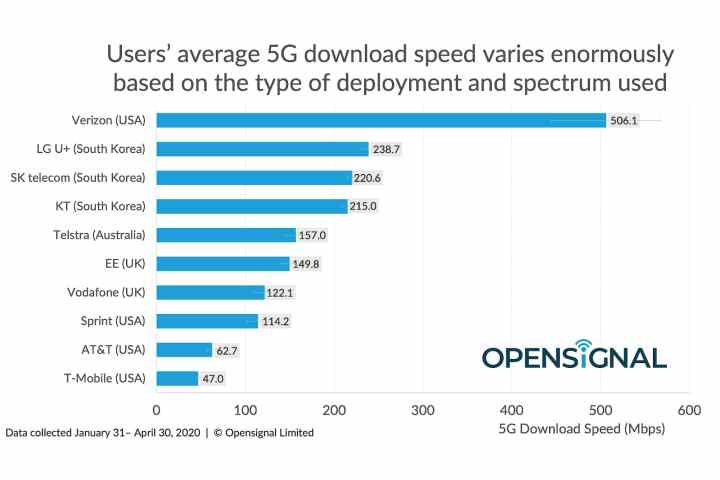

Using mmWave, Verizon could boast insanely fast speeds on its network, easily hitting 1Gbps and peaking at 4Gbps under ideal conditions. In early 2020, Verizon was the fastest 5G carrier on the planet, with an OpenSignal report showing average 5G download speeds of 506Mbps — double that of the second place contender, South Korea’s LG U+. Today, this level of Verizon’s 5G coverage is what’s known as 5G Ultra Wideband.

OpenSignal

OpenSignal

The only problem is that while mmWave may be fast, it also has an extremely short range — a single mmWave transceiver can only cover an area about the size of a city block. As a result, Verizon’s 5G service was only available to around 1% of its customers: those who lived or worked in major urban centers like downtown Chicago. Verizon customers in the rest of the U.S. never saw the 5G symbol appear in their phone’s status bar.

Verizon goes “Nationwide” with 5G

This limited range was a problem for Verizon, particularly since its rivals weren’t standing still. By the summer of 2020, T-Mobile was boasting 5G coverage in all 50 U.S. states — including Alaska — and AT&T wasn’t far behind. These networks may have been slower than Verizon’s ultrafast mmWave service, but at least customers on those carriers got to see the coveted 5G icon light up on their phones.

Verizon had to do something to catch up; the answer was its 5G Nationwide network. In the fall of 2020, the carrier made a pretty big splash when Verizon CEO Hans Vestberg took the stage during Apple’s launch of the iPhone 12 to announce that its 5G Nationwide network would bring 5G to the other 99% of its customers.

Apple

Apple

Of course, Vestberg didn’t put it quite that bluntly. Instead, he suggested that “5G just got real” thanks to the broader coverage. The new 5G Nationwide network promised coverage for 200 million more people across more than 1,800 towns and cities.

Before that, Verizon’s 5G network didn’t have a unique name; it was just Verizon’s 5G service. Once the carrier switched on its 5G Nationwide service, it became necessary to differentiate it from the much faster mmWave service. So, the 5G Ultra Wideband service was born, along with a new “5G UW” (or “5G UWB”) icon so customers would know when they were on the carrier’s fastest network.

Verizon

Verizon

The trick to getting 5G coverage expanded across the nation was that Verizon had to drop down to an entirely different set of frequencies. With the limited range of high-band mmWave spectrum, Verizon’s 5G Ultra Wideband network would have required hundreds of thousands of transceivers to offer the same coverage. According to a 2017 Qualcomm research paper, providing a square kilometer of reliable mmWave 5G coverage in a densely populated city requires approximately 130 mmWave transceivers. Based on those numbers, covering only 95% of New York City would require nearly 60,000 individual mmWave towers.

The challenges of low-band 5G

Since mmWave wasn’t going to cut it for a national expansion, Verizon had to take a different approach. With few other options available, the carrier had to use the same low-band frequencies occupied by its existing 4G/LTE service. Putting 5G signals down at 850MHz allowed Verizon to provide expansive 5G coverage — at the cost of true 5G performance.

The first problem is that low-band frequencies are already the slowest out there. That’s just how the laws of physics work. However, Verizon faced another challenge. 4G/LTE signals were already traveling on those airwaves, meaning Verizon’s new 5G Nationwide service had to share the road with a significant amount of slower traffic.

Mavenir

Mavenir

Fortunately, a technology known as Dynamic Spectrum Sharing (DSS) was created as part of the 5G specification to make this possible. Unfortunately, DSS makes 5G traffic a second-class citizen on the 4G/LTE airwaves. Since 4G/LTE has no equivalent feature, it doesn’t know how to share, so 5G traffic gets inserted into the leftover spaces between 4G signals.

If you’ve ever wondered why your 5G smartphone never seemed to perform much better than your old 4G/LTE one, this is the reason. That was especially true for Verizon customers since, until recently, they were much more likely to be using the carrier’s 5G Nationwide network than its 5G Ultra Wideband service.

Thanks to DSS, performance on Verizon’s early 5G Nationwide network was so bad that PCMag’s Sascha Segan told iPhone users on Verizon to shut 5G off entirely after several tests revealed that it was slower than 4G in major cities like New York and Chicago.

C-band to the rescue

While Verizon has been working on improving performance on its low-band 5G Nationwide network, there’s only so much it can do. The nature of DSS means that as long as most customers still have 4G/LTE devices, 5G signals will have to settle for second place on those frequencies. Things will improve organically as more folks move to 5G devices, but that won’t happen overnight.

Thankfully, a much more significant improvement came to Verizon’s 5G network earlier this year when the carrier deployed a swath of midrange C-band spectrum. Nestled in the 3.7 to 3.98GHz range, these frequencies are not only free of domineering 4G/LTE traffic, but they offer better performance than the low-band 850MHz frequencies and considerably better range than the 28GHz mmWave spectrum.

Dish Wireless

Dish Wireless

This spectrum has effectively become the sweet spot for 5G rollouts, and it’s not hard to see why Verizon dropped a record-setting $45 billion in a Federal Communications Commission (FCC) auction to acquire it last year. Following a kerfuffle with the aviation industry, the carrier turned the switch on the new spectrum in January. The result was remarkable performance improvements for many of its customers.

Verizon incorporated the new C-band spectrum into its 5G Ultra Wideband network, so it’s not technically an improvement to its 5G Nationwide service. However, the expansion means you’re less likely to find yourself on the slower nationwide service unless you’re taking a road trip or live in a rural area.

The competitive 5G landscape

Verizon isn’t alone in segregating its 5G networks, but it is the most aggressive of the bunch when it comes to promoting the differences between its 5G Nationwide and 5G Ultra Wideband. This is likely because Verizon is also unique in charging extra for its fastest 5G service. Unless you’re on one of the carrier’s premium 5G Do More, Play More, or Get More plans, you’ll be limited to low-band 5G Nationwide service even if you’re standing right next to a mmWave transceiver in downtown Chicago and could technically use 5G Ultra Wideband.

AT&T and T-Mobile also have their own names for their different levels of 5G service. AT&T simply calls its standard network “5G” and uses the name 5G Plus (5G+) for its mmWave network. AT&T’s 5G is a low-band service similar to Verizon’s 5G Nationwide, with many of the same challenges. 5G Plus is a similar combination of mmWave and C-band as Verizon’s 5G Ultra Wideband service, although AT&T has limited mmWave to dense areas like stadiums and airports, and it’s only rolled out C-band in about eight cities.

AT&T also has a “5GE” network, but that’s nothing more than a marketing stunt where the carrier tried to convince customers that its Advanced 4G/LTE network was actually an “evolution” to 5G. 5GE is not 5G at all; it’s just a misleading icon for AT&T’s best 4G/LTE service.

Adam Doud/Digital Trends

Adam Doud/Digital Trends

T-Mobile has taken an entirely different approach to its 5G rollouts. While the Un-carrier does have some mmWave spectrum, it doesn’t talk much about that since it’s mostly there to supplement the rest of its network, improving service in dense areas like stadiums that need extra capacity. Instead, T-Mobile began its 5G rollouts, focusing on broad coverage through a low-band “standalone” 5G network using a 600MHz spectrum. While these low frequencies were the slowest of them all, they were free of 4G/LTE traffic. This means T-Mobile’s low-band 5G network didn’t need to rely on DSS. This is what the carrier now calls its 5G Extended Range network.

T-Mobile had another ace up its sleeve. Through its merger with Sprint, T-Mobile acquired licenses for a sizeable chunk of the 2.5GHz spectrum. Sprint had been using this for its 4G/LTE network, but T-Mobile quickly decommissioned those towers to free it up for 5G, giving it a considerable head start on its rivals. This became T-Mobile’s 5G Ultra Capacity network. As a mid-band network, it’s roughly equivalent to Verizon’s 5G Ultra Wideband and AT&T’s 5G Plus.

The state of 5G Nationwide and 5G Ultra Wideband in 2022

While Verizon is far better off than it was at the end of 2021, the carrier has its work cut out if it wants to catch up with T-Mobile. A July 2022 market report from Ookla shows T-Mobile still holds a commanding lead in 5G performance and reliability, taking first place in 45 states and coming in with nearly double the median download speeds across the board.

Since these tests measure median download speeds across all carrier service levels, they mostly show how much the low-band networks are holding 5G back. Verizon’s 5G Ultra Wideband network has proven itself to be quite capable, but sadly too many of its customers remain on the much slower 5G Nationwide network — either because they’re not covered by 5G Ultra Wideband yet or they’re unwilling to pay more for a premium plan. That’s not a problem T-Mobile customers face since even the entry-level 5G plans include access to the carrier’s faster and more expansive 5G Ultra Capacity network.